Welcome back from your holiday slumbers to the Weekly Register: Year End Edition. Hopefully, everyone enjoyed some quality time with family and friends. But let’s get back to work.

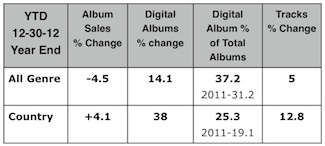

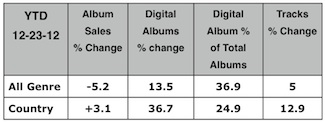

The graphs tell the top level tale. Country and All-genre album sales ended about 4 percentage points on opposite sides of flat. Country finished the year up 4.1% (44.694 million; 2011—42.923; + 1.77 million) and all-genre sales shrunk -4.5% (315.844 million).

Country also enjoyed stronger increases in digital album sales (country +38%; all genre +14.1%) and track sales (country +12.8%, all-genre +5%).

As expected, when measuring digital albums as a percentage of total albums sold the shift to digital continues. The all-genre audience has a higher preference for digital product (country 25.3%; all-genre 37.2%), but both groups added about 6 percentage points to last year’s tally (see grid).

As expected, when measuring digital albums as a percentage of total albums sold the shift to digital continues. The all-genre audience has a higher preference for digital product (country 25.3%; all-genre 37.2%), but both groups added about 6 percentage points to last year’s tally (see grid).

For the past few weeks we have focused upon Taylor Swift’s incredible sales performance—a lot. Is that because we can’t spell any other artist names? Or because Ms. Swift is sending us to the Caribbean for a vacation? Unfortunately, “no.” We are highlighting her achievements because they are astronomical. Red reigns at No. 1 again on both the country and Top 200 album charts with weekly sales of over 241k, creating a 10-week total of 3.11 million units.

Swift also topped both the country and all-genre digital tracks charts—with different songs! “We Are Never Ever…” topped the country tracks chart with almost 236k downloads for the week (3 million RTD). “I Knew You Were Trouble” was No. 1 on Current Digital tracks with over 582k mouses clicking to download the track!!!! (2.04 million RTD).

Evaluating The Bigger Picture

Country album sales increased 4.1% this year, or by 1.77 million albums. Is that good?

Country album sales increased 4.1% this year, or by 1.77 million albums. Is that good?

It’s fair to conclude that it could be much better. Like every year, there were winners and losers—but a problem facing everyone is profitability. While costs are rising across the board for artist development, marketing, promotion and distribution, prices are falling and margins are shrinking. Sadly, the music industry witnessed the demise this year of once proud major label Capitol/EMI. And the worrisome all-genre showing (-4.5%) fuels speculation that more shrinkage lies ahead.

Many pundits believe the music industry is transitioning from physical product to an “access” model. Someday soon streaming will made as easily available on your auto dashboard as it already is on the desktop and mobile. Are you going to care about moving files from hard drive to hard drive once you see that all the music you ever wanted is instantly available wherever/whenever you want it? Right.

But does the industry have a model that can compensate its creators—songwriters, publishers, labels, artists and producers? Unfortunately, the answer is “Not yet.” That is a concern as we enter 2013.

According to SoundScan, country sold 77.912 million albums in 2004. Eight years later we find ourselves selling 43% less, with lower margins, prices and profits.

So yes, it’s exhilarating to watch Taylor Swift wave the country banner proudly around the world on her way to becoming the largest selling Nashville artist ever. It’s also rewarding to note that Nashville has become a creative mecca with highly distinctive artists such as Jason Aldean, Carrie Underwood, Eric Church, Brantley Gilbert, Little Big Town, Lady Antebellum, Zac Brown Band, Miranda Lambert, Blake Shelton, Jamey Johnson, Colt Ford and more. But there are challenges ahead for music professionals from all genres.

It’s time we started to prepare…

=========================

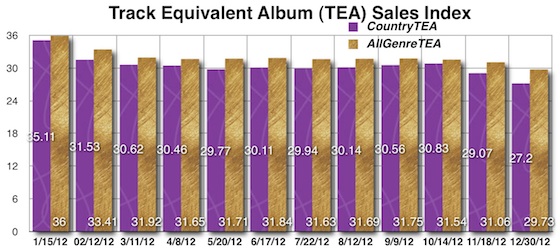

The MusicRow TEA Index sums physical, digital and TEA (track equivalent albums; 10 tracks=1 album) then calculates the percentage of total album sales that come from TEA. The idea is to measure the TEA effect against total album sales. (Our baseline numbers are gathered by industry sources from Nielsen SoundScan.) The 2011 full year TEA Index was 25% country and 27.7% all-genre, and it has expanded to 27.2% and 29.73%, respectively.

The holiday album rush lowered the last month’s numbers which dropped about 2 percentage points for both categories. The TEA index is another way to show that despite the popularity of tracks, they still account for less than one-third of overall album/track sales.

Category: Artist, Featured, Sales/Marketing

About the Author

Journalist, entrepreneur, tech-a-phile, MusicRow magazine founder, lives in Nashville, TN. Twitter him @davidmross or read his non-music industry musings at Secrets Of The ListView Author Profile