By way of a brief recap from parts one and two of our year-end sales trilogy, (click for part 1, part 2) readers will recall that country album sales, including physical and digital album downloads, ended 2011 with sales of 42.923 million units, about 1.8% behind last year’s efforts.

By way of a brief recap from parts one and two of our year-end sales trilogy, (click for part 1, part 2) readers will recall that country album sales, including physical and digital album downloads, ended 2011 with sales of 42.923 million units, about 1.8% behind last year’s efforts.

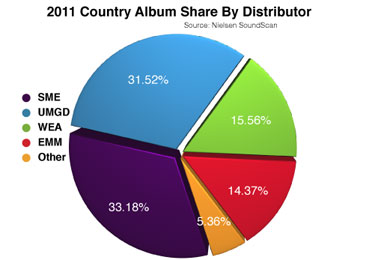

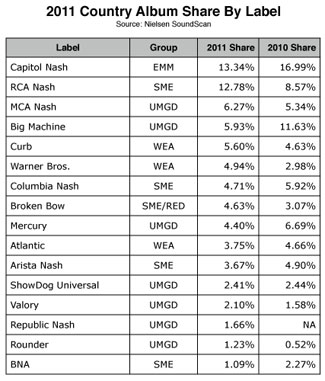

In this final installment we present a comprehensive breakdown of how country sales played out by distribution group, by individual imprints and the top ten selling digital track artists. Capitol Nashville and RCA Nashville led the charge with market shares of 13.34% and 12.78% respectively. In third place was MCA Nashville with a 6.27% share. The 2010 shares are also listed to give perspective. Many of the shifts, both up and down are a reflection of release schedules. For example Big Machine had 11.63% share in 2010, boosted largely by the release of Speak Now from its flagship artist Taylor Swift which debuted with over one million units its first week. Sony Music Entertainment lead the country distribution groups with 33.18% marketshare. Universal followed closely with 31.52%. If the UMGD/EMM merger had already taken place, the newly formed entity would account for about 46% marketshare, a large majority destined to reshape elements of the country landscape.

Hidden in the numbers is the realization that increased catalog sales were responsible for propping up the overall sales numbers. Soundscan tells us that on average across all genres, current sales dropped 4.2% while catalog and deep catalog units were up 8.9% and 12.5% respectively. Unfortunately, we don’t know the exact breakout for country music. However, a brief look at country’s final sales week of 2011 supports catalog also played a leading role.

Hidden in the numbers is the realization that increased catalog sales were responsible for propping up the overall sales numbers. Soundscan tells us that on average across all genres, current sales dropped 4.2% while catalog and deep catalog units were up 8.9% and 12.5% respectively. Unfortunately, we don’t know the exact breakout for country music. However, a brief look at country’s final sales week of 2011 supports catalog also played a leading role.

For example, comparing the final week of 2011 with the final week of 2010 we find an increase of 99,000 units in 2011. When comparing sales from the current Top 75 charts and Top 50 Catalog charts the differences do not account for the extra 99k. Therefore, it seems logical that those units are increasingly coming from the long tail/deep catalog area. Why are we concerned with making this distinction? Because much of that older catalog has been moved into the $5 retailer bins. Short story (and bad news) is that although unit sales are down only 1.8% it is highly likely that revenues and profits are down significantly more than 1.8% because a higher percentage of the sold units were sold at the lower catalog prices.

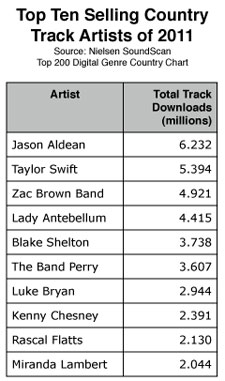

Based exclusively upon the Digital Genre Country Top 200 Year End 2011 chart, the Top Ten selling digital track artists lined up on a steep slope. Jason Aldean easily took first place this year with Taylor Swift, Zac Brown Band, Lady Antebellum and Blake Shelton filling out the Top 5.

As we look toward 2012, the issues we have been examining over the past year will continue to present unique challenges for country label sales and marketing divisions. The transition from physical to digital will accelerate, but let’s not lose sight of the fact that in 2011 physical albums accounted for about 81% of the country business. As shelf space continues to erode at the mass merchandisers, no doubt downward pressure on pricing will continue. Track Equivalent Albums are also likely to take a more important seat at the sales discussion table in the coming year.

As we look toward 2012, the issues we have been examining over the past year will continue to present unique challenges for country label sales and marketing divisions. The transition from physical to digital will accelerate, but let’s not lose sight of the fact that in 2011 physical albums accounted for about 81% of the country business. As shelf space continues to erode at the mass merchandisers, no doubt downward pressure on pricing will continue. Track Equivalent Albums are also likely to take a more important seat at the sales discussion table in the coming year.

One beautiful fact never changes, great music rises to the top… So here’s to a great 2012….and the great music it will produce!

Category: Exclusive, Featured, Sales/Marketing, Weekend

About the Author

Journalist, entrepreneur, tech-a-phile, MusicRow magazine founder, lives in Nashville, TN. Twitter him @davidmross or read his non-music industry musings at Secrets Of The ListView Author Profile