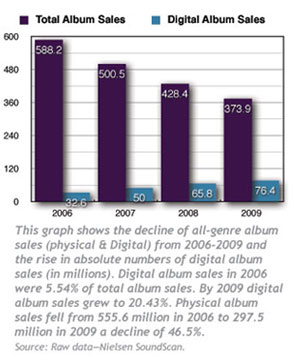

The chaotic, forced restructuring of the global music industry is not a well kept secret. Stats abound from SoundScan, the RIAA, various research projects, IFPI and others that clearly demonstrate hurricane strength winds of change.

Unfortunately, there is little public dialog among major stakeholders regarding the massive shift unleashed by the digital era. Occasionally we hear lip service about “new models” that aren’t very new. And bizniks rush to brand each of the declining number of success stories as “revolutionary,” when realistically it is the talent and personality driving the process, not methodology. Finally, the circle of pain now stretches end to end. The labels were first to suffer, but publishers, songwriters, distributors and touring have now been added to the list of those impacted.

With so many unanswered industry concerns, it was gratifying to see Charlie Anderson, CEO/President of Anderson Cos. stand publicly to address CD sales, in a recent Billboard Q&A (7/17/2010; page 9). Anderson Cos. is the umbrella entity for Anderson Merchandisers, rackjobber to Walmart and Sam’s Club and the military which according to the trade publication distributes about 12.5% of the U.S. CD market and is country music’s largest sales partner. Anderson has served as Chairman of the Country Music Association and still serves on its Board of Directors.

Succinctly stated, Anderson predicts that on its current course, the CD business will end sooner than most record labels anticipate. “Label executives think that at the end of three years it could be a much smaller industry, but don’t project that they will go away,” Anderson says. “But if nothing is done for CD sales there will come a day when Walmart, Target and Best Buy will say, ‘It’s just not worth it anymore.'”

Succinctly stated, Anderson predicts that on its current course, the CD business will end sooner than most record labels anticipate. “Label executives think that at the end of three years it could be a much smaller industry, but don’t project that they will go away,” Anderson says. “But if nothing is done for CD sales there will come a day when Walmart, Target and Best Buy will say, ‘It’s just not worth it anymore.'”

Anderson bravely offers a five step plan to extend the life of the CD an additional three years (6 total) which he hopes will allow time to “create new revenue streams.”

In the spirit of honest debate, and to keep the discussion alive, MusicRow visited with some anonymous industry heavyweights to gauge reaction to Anderson’s ideas. We also asked, “Is keeping the CD alive a worthwhile endeavor? Or are we simply prolonging the inevitable loss of a product which will be less painful if done quickly?”

Two of Anderson’s five steps are related to pricing.

1) “We suggest that instead of having a 99¢ or $1.29 single compete against a $12.50 album, we should reduce the price of CD albums to significantly under $10.”

2) “Presently artists put out an album with 14-16 cuts on it every 18 months. We recommend going to six to eight cuts and coming out with a CD every six months. We will need to release product more frequently to keep the artist relevant.”

Three of the five steps try to transfer some of the digital advantages to the physical side.

3) “When you buy a CD you should also…receive a digital copy of what you just bought.”

4) “We should get the CD the same day the labels are delivering the song to radio and iTunes. Many times when we get a CD they have already released two digital singles and there is nothing left to buy.”

5) “We ask that the record labels deal on consignment which would put us on the same field as iTunes. If we did this retailers would be slower to cut the space and hopefully more amenable to adding catalog product.”

The mix of industry stakeholders and marketplace factors is like a Rubik’s cube of opinions and connected outcomes. And despite one’s opinion of the best pathways, it is instructive to note the popularity of the physical CD for country fans. YTD 2010, about 85% of the approximately 20 million country albums sold were physical CDs, down from last year at this time when about 89% were physical CDs. Looking at the industry overall for perspective, only 72.5% of the 170 million all-genre album units scanned were physical YTD. So with respect to country music, the CD remains a more significant revenue producer.

Digital tracks are now widely available at iTunes, Amazon and soon at Google for 99¢—to $1.29. So it seems intuitive that CD pricing should not be greater than the per track sum. Programs like iTune’s “Complete the Album” let fans purchase tracks one at a time and then opt to get the complete album later without paying extra. It makes the process risk free to the consumer which raises the question, “Why would a consumer want to pay a higher per track price plus buy them all at once in a physical package?” Anderson’s suggestion that CD prices be lowered to, “significantly under $10” seems well advised. But there is the nagging problem of costs, margins and profits to deal with, which is heightened with respect to his championing of the less expensive six track package.

The question is can the labels make money for all artists under the new six cut scenario? One executive responds, “The distribution fee doesn’t lower, manufacturing doesn’t lower, mechanicals don’t lower, overhead doesn’t lower, promo & marketing don’t lower. Wholesale price is around $3.50. 55¢ in mechanicals, 80¢ in production, $1.10 distribution fee, $1.10 artist royalty…Even if wholesale is $4, it doesn’t add up for the label.”

When asked by MusicRow if Anderson Merchandisers would be willing to also lower its fees Anderson replied, “If the retail price drops from say $12 to $6 my company makes exactly half of what we made before. Or to put it another way, we must sell twice as many at $6. It’s not what I want. It’s just where we are. We must offer a better value to the consumer.”

Better value, may in fact be an important concept. Controversial industry spokesperson Bob Lefsetz writes in a recent editorial, “Files have replaced CDs. Quote all the SoundScan statistics you want. Then call Eric Garland at BigChampagne. Illegal trading of files far outstrips physical sales, to the point where the latter are essentially irrelevant. End result, everybody’s got a lot of music, and this is good. The only piece of the puzzle left is to move the public to paid services providing everything all the time for a low price. Emphasis on low price. The majors refuse to win this war, refuse to collect a little if it insures they won’t collect a lot. But rental/streaming/rented tracks living on handsets is the legal solution that’s imminent. Just like digital books.”

If it is true that lower prices will spur increased volume, then publishers and labels will need to work together on pricing and royalties. Presently song mechanicals are fixed at 9.1¢ per track regardless of the sales price. At a price of 99¢ that is about 9%. However, if a label lowers the track price to 50¢ they still are required to pay the same 9.1¢ in mechanical royalty (18%) which makes experimenting with downward pricing very difficult.

If the mechanical rate was calculated as a percentage, might it ultimately achieve greater revenues for publishers and labels through lower prices? We don’t know, but it would be in the entire industry’s interest to find out.

One executive notes, regarding Steps 3 and 5 above, “Call your favorite publisher and ask if they will allow a gratis license or a two-for-one mechanical royalty. The labels will get caught holding the bag on that one. And consignment? We are basically already on consignment. They can return product with no penalty for 60-120 days depending upon the release.”

Jay Frank, SVP Music Strategy CMT was on a panel with Charlie Anderson at the recent Billboard Country Music Summit, where Anderson spoke about his five step plan. Frank agreed that music needs to be released more frequently, but questioned trying to save the CD. “Trying to extend the life of the CD is like going back to the rotary phone and saying let’s keep this around a while longer,” says Frank. “We think of ourselves as a business of CDs transferring into the digital download business; but for the young consumers, we are in the digital download business transferring into the cloud-based streaming business. Recognizing multiple streams plus releasing music more often is going to be a winning combination.”

Another executive summarizes with a bit of anger. “Walmart won’t care when the rackjobber or the labels are gone—out of WM. Physical is not the future. We shouldn’t run from the CD, but we can’t assume giving away our product with very little margin will keep us in business three years longer than he’s projecting. Anderson Merchandisers has an army of people racking stores. Get into more chains! Get into more stores! We’re going to sit here and let WM dictate? How stupid is that?”

In a perfect economic world, optimizing the balance between price, supply and demand is straightforward. But that model assumes product scarcity. With illegal free music readily available, scarcity is challenged and the ability to raise and/or maintain prices weakened. Imagine trying to raise the price of snowflakes in the middle of a blizzard.

Is there a single answer to all the problems facing the music industry? Probably not. But continuing the discussion and experimenting may be the best way to forge some solutions.

Category: Featured, Label, Publishing, Sales/Marketing

About the Author

David M. Ross has been covering Nashville's music industry for over 25 years. dross@musicrow.comView Author Profile