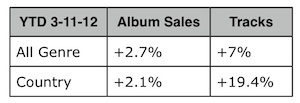

The Country Music Sales Landscape is evolving rapidly. According to Nielsen SoundScan, Country tracks are up 19.4% (7% for all genre) and digital album sales are up 30.8% (19.4% all genre) YTD 2012. These numbers show a significant increase in the adoption of digital music by country fans, albeit several years behind the all genre crowd.

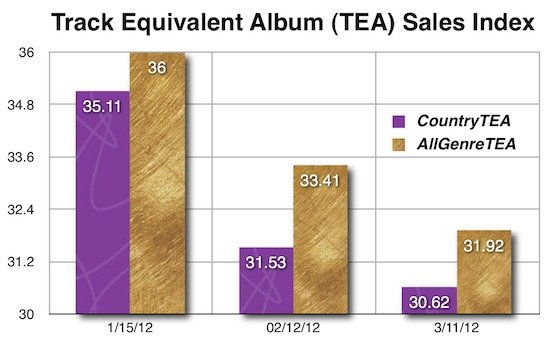

Digital album sales are included in SoundScan album sales, which has been the coin of the realm in measuring industry health. But track sales are generating large revenues, and frankly becoming too important to ignore. The TEA index is one of several coming metrics designed to fold track sales back into the discussion.

TEA Index Methodology

We will update the TEA index around the middle of each month. Here’s how it works. We take the total YTD track sales and divide the number by 10 to get TEA (track equivalent albums) units. We then add the TEA albums to the digital and physical albums to get a total. Lastly we determine what percentage of the total is contributed by TEA units.

The percentage shows at a glance how the marketplace is changing. For example, the 2011 TEA index for country music was 25.08% (all genre 27.77%). Three months into 2012 the country TEA index has already risen to almost 31%—a 24% increase.

Looked at another way, the index is dependent upon the balance between tracks and albums. For example, if album sales fall and tracks remain constant, the index rises. Conversely, if album sales increase and track sales remain constant or ebb then the index falls.

TEA Talk

The higher TEA index scores at the start of the year can probably be explained by the post holidays gift card phenomenon when people get new gifts and then rush online to redeem them in the form of buying tracks. But we are also seeing track sale spikes generated by award shows like the Grammys, as well as reality shows such as American Idol and The Voice and sitcoms Smash and Glee which encourage “instant gratification” track purchases.

This past week the index dropped, partially because of some special 25¢ digital album offers, first from Google and then echoed by Amazon which successfully stimulated album downloads (more about that below.) Special sales like this highlight another disconnect between SoundScan numbers and actual industry health—pricing. For example, country album sales last year were down a modest 1.8%. No big deal until you start to realize that albums were selling for less last year than in previous years, so revenues were more seriously compromised than the 1.8% would indicate and of course profits also suffered.

Weekly Sales Shout Out

Lady Antebellum’s Own The Night was the largest single happening of the week for country album sales. Its sales increased 437% W/W. The trio benefited from the aforementioned 25¢ sales price on Google Music—an offer that really “clicked” with fans. Sales moved from 20k to 108k with a whopping 90% of the sales in the digital format!

Lady Antebellum’s Own The Night was the largest single happening of the week for country album sales. Its sales increased 437% W/W. The trio benefited from the aforementioned 25¢ sales price on Google Music—an offer that really “clicked” with fans. Sales moved from 20k to 108k with a whopping 90% of the sales in the digital format!

Informed readers will recall that after last year’s Lady Gaga low debut-week pricing, Billboard added a new chart rule saying it would not include album units sold for less than $3.49 during their first four weeks of release in SoundScan. But Own The Night, now in its 26th week, is way past the four week rule.

Luke Bryan also deserves mention with the No. 2 and No. 3 positions on this week’s country album chart. His Spring Break 4 debut hit almost 30k downloads (it was digital-only) and Tailgates and Tanlines scanned over 17k.

Category: Artist, Featured, Label, Sales/Marketing

About the Author

Journalist, entrepreneur, tech-a-phile, MusicRow magazine founder, lives in Nashville, TN. Twitter him @davidmross or read his non-music industry musings at Secrets Of The ListView Author Profile