The Digital Music Report 2012 is an in-depth look at worldwide trends. Released Monday by the International Federation of the Phonographic Industry, the report covers revenue, subscription and download models, piracy and more. Highlights and summary are below. Click here to download the full report, or here for an outline of key facts.

The Digital Music Report 2012 is an in-depth look at worldwide trends. Released Monday by the International Federation of the Phonographic Industry, the report covers revenue, subscription and download models, piracy and more. Highlights and summary are below. Click here to download the full report, or here for an outline of key facts.

Digital Revenue Rising

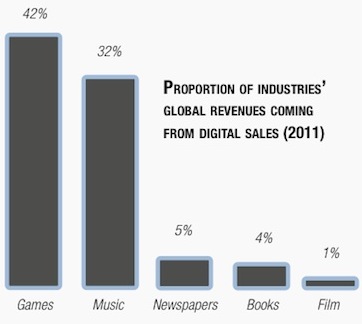

Digital channels account for about 32 percent of record company revenues globally, up from 29 percent in 2010. Some markets now see more than half of their revenues derive from digital channels, including the US (52%), South Korea (53%) and China (71%).

Global digital revenues to record companies grew by an estimated 8 percent to $5.2 billion in 2011. This compares to growth of 5 percent in 2010 and represents the first time the year-on-year growth rate has increased since IFPI started measuring digital revenues in 2004.

Access and Ownership Models

Ten years after the first online stores emerged in the US and Europe, digital music is now broadly segmented into two main consumption models: “ownership” and “access.” Ownership usually refers to download services such as iTunes and Google Music. The access model is typically a subscription service such as Spotify.

According to the report, both models have enormous growth potential. At the start of 2011, the largest international digital music services were present in 23 countries. One year later they are present in 58 countries. Rob Wells, president, global digital business, Universal Music Group, explains, “The fact that these two models of consumption can co-exist speaks volumes about the future. In fact, we have really only scratched the surface of digital music in the last decade—now we are starting the real mining, and on a global scale.”

Spurring digital music growth is the rising prevelance of smartphones, tablets and broadband. “The technology infrastructure is being put in place in a way that we have never seen before and that is one major reason why we feel positive about digital music going into 2012,” adds Edgar Berger, President and CEO, International, Sony Music Entertainment.

Another bright spot is the growing popularity of online radio and music videos. The most watched artist on YouTube is Justin Bieber, whose videos have been viewed more than two billion times.

Sources: PWC Global Entertainment & Media Outlook and IFPI. Notes: games includes players’ purchases of accessories and additional game content as well as subscriptions. Music share is based on trade revenues. Newspapers include digital advertising and subscriptions. Books excludes audio books. Film excludes online sales and rentals of physical discs.

Download Services

IFPI estimates that 3.6 billion downloads were purchased globally in 2011, an increase of 17 percent (combining singles and album downloads). Single track downloads are up 11 percent by volume, and digital albums are up 24 percent by volume.

Download stores account for a large proportion of digital revenues and account for most of the 500 legitimate services worldwide, offering libraries of up to 20 million tracks. The most popular download store, iTunes, continued growing in 2011. iTunes opened for business in 28 additional markets, reaching more than 50 countries. Download service 7digital is now available in 37 countries.

Though singles are growing in popularity, up 10 percent in the US (Nielsen SoundScan), the album isn’t dead. Digital album volume sales have grown steadily in recent years, with US digital album sales in 2011 up 19 percent (Soundscan). In the US digital albums already account for 31 percent of all album sales by volume. Driving demand for digital albums are strong marketing campaigns, premium offerings that provide additional content, consumer habits and growing computer storage space.

The top selling single of 2011 was Bruno Mars’ “Just The Way You Are,” which sold more than 12.5 million copies.

Subscription Services

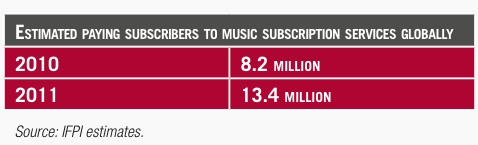

The number of consumers subscribing to music services globally is estimated to have increased by nearly 65 percent in 2011, reaching more than 13 million, compared to an estimated 8.2 million the previous year. This supplements the tens of millions of consumers who already use download services.

Subscription services Spotify, WiMP and Deezer are expanding fast across national borders. Spotify launched in the US and four European markets and now reaches 12 countries. The US also saw the launch of Muve Music in 2011.

Piracy Remains

It’s no secret digital piracy remains a critical barrier to growth and investment by record companies. Twenty-eight percent of internet users globally access unauthorized services on a monthly basis, according to IFPI/Nielsen.

There has been positive momentum in the fight against piracy in 2011. In the US, an ISP cooperation deal was signed in 2011 and a graduated response program will be implemented in 2012, with most major ISPs signing up to a “copyright alert system.” The move follows the closure of the illegal service LimeWire in 2010, which has helped cause a dramatic drop in levels of P2P piracy in the US market.

A similar law in France, the Hadopi graduated response law, has seen peer-to-peer (P2P) piracy levels decline by 26 percent since warning notices were first sent out in October 2010, according to IFPI/Nielsen. A newly-published academic study finds that single track sales were 23 percent higher than they would have been in the absence of Hadopi.

Mark Piibe, executive vice president, global business development, EMI Music, sums, “We know that some people will migrate from piracy and that others will not, but we want alternatives to be there.”

Category: Artist, Exclusive, Featured, Sales/Marketing

About the Author

Sarah Skates has worked in the music business for more than a decade and is a longtime contributor to MusicRow.View Author Profile